michigan sales tax exemption number

This license will furnish a business with a unique Sales Tax Number otherwise referred to as a Sales Tax ID number. Use tax of 6 must be paid to the State of Michigan on the total price including shipping and handling charges of all taxable items brought into.

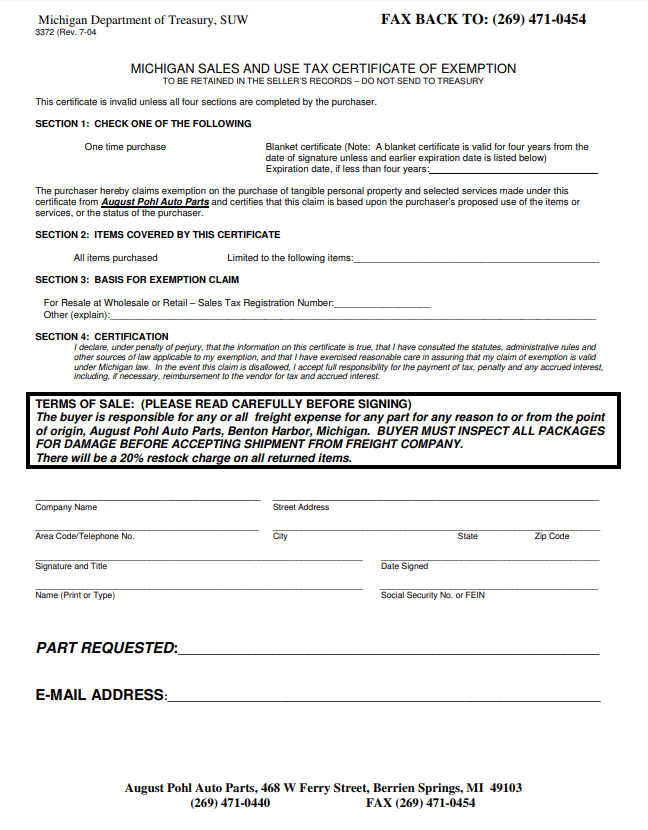

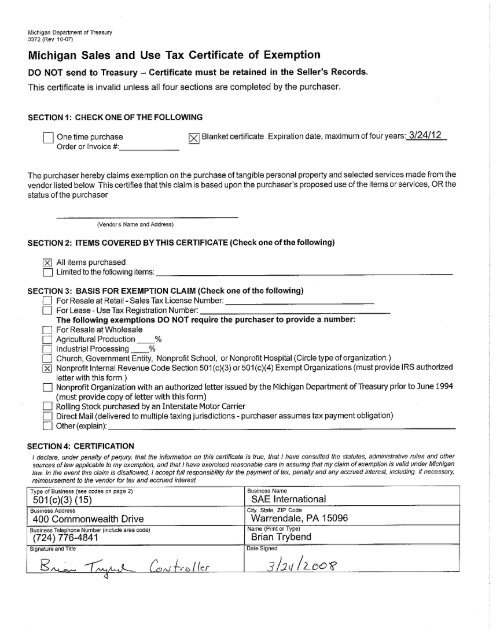

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

This exemption claim should be completed by the purchaser provided to the seller.

. Michigan has a statewide sales tax rate of 6 which has been in place since 1933. Municipal governments in Michigan are also allowed to collect a local-option sales tax that ranges from. Certain businesses are exempt from paying sales and use tax including.

In Michigan certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Sales Tax Return for. The Michigan Department of Treasury does not issue tax exempt numbers.

This means that the business or entity making the purchase is exempt from paying sales tax. What Is Exempt From Sales Tax In Michigan. If you are looking to purchase goods in Michigan and you have tax-exempt status you need to fill out this form and present it to the.

2022 Sales Use and Withholding Taxes MonthlyQuarterly Return. 01-21 Michigan Sales and Use Tax Certificate of Exemption. Refer to this guide for common reasons that a business would be exempt from.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making. For other Michigan sales tax exemption certificates go here. The Michigan General Sales Tax Act took effect June 28 1933.

Use our software to prepare Michigan Taxes such as Personal Property Tax Sales Use Withholding Tax and Unemployment Taxes. Notice of New Sales Tax Requirements for Out-of-State Sellers. No Michigan does not issue sale tax licenses to wholesalers.

Direct Pay -Authorized to pay use tax on qualified transactions directly to Michigan Treasury under account number. Form 3372 Michigan Sales and Use Tax Certificate of Exemption is used in claiming exemption from Michigan sales and use tax. Exemption entities may complete the.

Several examples of exemptions to the states sales tax are vehicles. Direct Pay -Authorized to pay use tax on qualified transactions directly to Michigan Treasury under account number. Our software will also prepare Federal Taxes such.

Sales for resale government purchases and isolated sales were exemptions originally included in the Act. Michigan Sales and Use Tax Certificate of Exemption. If the retailer is.

For transactions occurring on and after October 1 2015 an out-of-state seller may be. Enter Sales Tax License Number. Form 3372 Michigan Sales and Use Tax Certificate of Exemption is used to claim exemption from.

Use tax is a companion tax to sales tax. To clarify there is no such thing as a sales tax exemption number for agriculture. In order to claim an exemption a wholesaler must provide the seller with a completed Form 3372 Michigan Sales and Use Tax.

Form Number Form Name. Streamlined Sales and Use Tax Project. How to use sales tax exemption certificates in Michigan.

Be cautious farmers should not use their social security number as proof for a sales tax. Certain 501c3 and 501c4 organizations for property used in the operations of the organization. Step 1 Begin by downloading the Michigan Resale Certificate Form 3372 Step 2 Indicate whether the transaction is a one-time purchase or a blanket certificate.

Michigan Department of Treasury 3372 Rev. TOP 5 Tips Sales of certain food products for human consumption many groceries Sales to the US. Enter Sales Tax License Number.

Once you have that you are eligible to issue a resale certificate.

Michigan Safety Equipment Exempt From Sales And Use Tax Doeren Mayhew Cpas

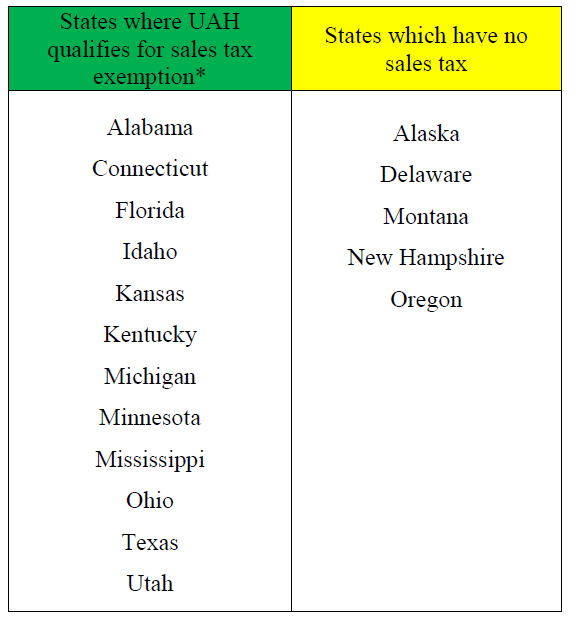

Uah Business Services News Tax Exemption Guidelines

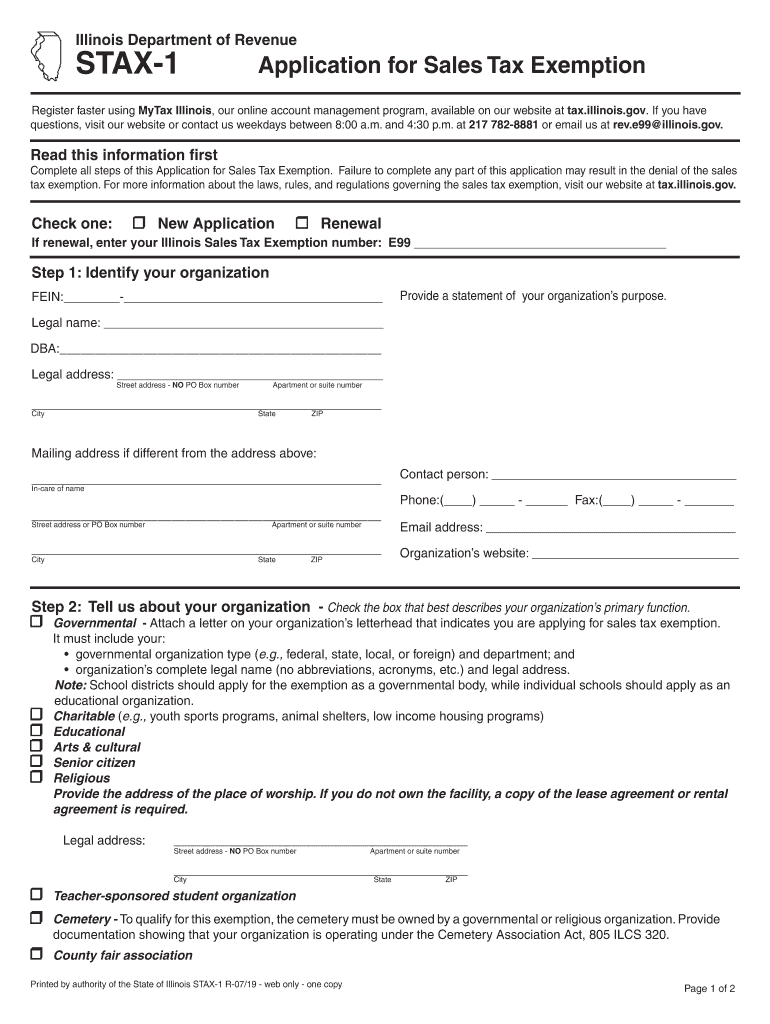

Stax 1 Fill Out Sign Online Dochub

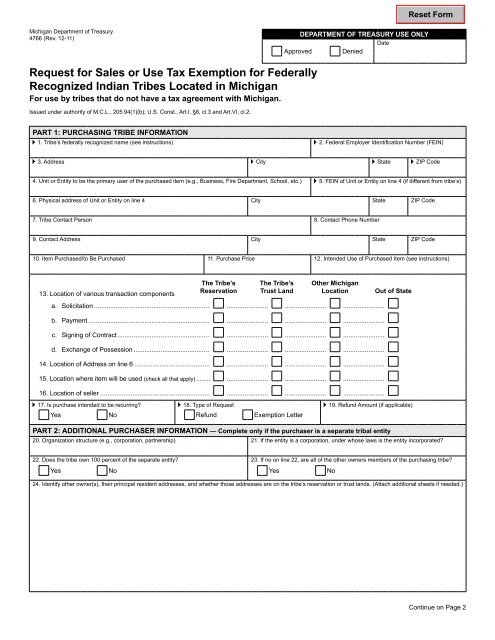

4766 Request For Sales Or Use Tax Exemption State Of Michigan

How To Register For A Sales Tax Permit In Michigan Taxvalet

How To Get A Sales Tax Exemption Certificate In Indiana Startingyourbusiness Com

Michigan Sales Tax Exemptions Agile Consulting Group

Michigan Sales And Use Tax Certificate Of Exemption Students Sae

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

Form 3372 Michigan Sales And Use Tax Certificate Of Exemption

How To Get A Sales Tax Exemption Certificate In Iowa Startingyourbusiness Com

Sales Taxes In The United States Wikipedia

Michigan Representative Makes Push To Exempt Infant Adult Diapers From Sales And Use Tax

Form 3372 Fill Out And Sign Printable Pdf Template Signnow

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption