are political contributions tax deductible for a business

None of these contributions is tax deductible for either individuals or businesses. The political organization taxable income equals its gross income excluding exempt function income less deductions allowed by the Code that are directly connected with producing gross income excluding exempt function income computed with certain modifications set forth in 527 including a specific deduction of 100.

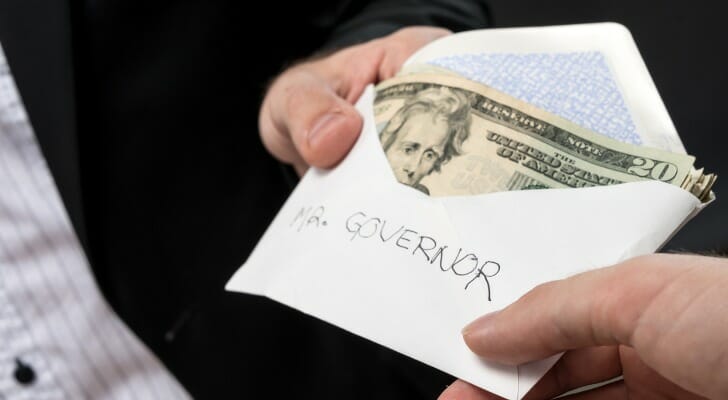

Are Political Contributions Tax Deductible Smartasset

1500 for contributions and gifts to political parties.

. This rule is so strict that the law even prevents political candidates from deducting the money they spend out of their own pockets while running for elected office. The exempt function. Most political contributions are not tax deductible.

There are five types of deductions for individuals work. Political Contributions and Expenses Paid. But when it comes time to file taxes many people dont know if.

For amounts over 750 33 will. Even though you cant deduct political donations as charitable contributions on your federal return doesnt mean all is lost. The most you can claim in an income year is.

The amount of the deduction for a contribution or gift of property is either the market value of the property on the day the contribution or gift was made or the amount. In fact individual political candidates cannot deduct any campaign expenses registration fees advertising or any other costs related to running. Any money voluntarily given to candidates campaign committees lobbying groups and other political organizations is non-deductible as per the IRS.

Contributions that exceed that amount can carry over to the next tax year. 1500 for contributions and gifts to independent candidates and members. As of 2020 four states have provisions for dealing with political contributions.

Are Donations Tax Deductible. Political contributions arent tax deductible. A tax deduction allows a person to reduce their income as a result of certain expenses.

Political contributions are defined as those made to political campaigns. The answer is no political contributions are not tax deductible. These business contributions to the political organizations are not tax-deductible just like the individual donations and payments.

It explains why political contributions are not tax deductible and it looks at other types of contributions that may be. Contributions or expenditures made by a taxpayer engaged in a trade or business designed to encourage the public to register and vote in Federal state and local elections and to contribute to the campaign funds of. Businesses cannot claim political donations as a tax deduction.

You cannot claim political deductions on your tax return for your business. With this your business is not allowed to deduct political contributions on its tax return. And if you check the box when filling out your tax return that asks if you want to give 3 to the Presidential Election Campaign Fund that isnt deductible either.

Are political donations tax-deductible for business. The IRS does not waver from its stance on expenses of this nature. Political Contributions and Expenses Paid by Businesses.

To be precise the answer to this question is simply no. You may wonder if these contributions are tax deductible. However Americans are encouraged to donate to political campaigns political parties and other groups in the political landscape.

Even though charitable donations can be deductible from your tax all donations made to politics cannot. Businesses likewise cannot claim a deduction for political contributions whether theyre pass-through entities or file a corporate return. This guide is designed for people who have made political contributions and are wondering about their deductibility.

Business OwnerSelf Employed Tax. A business tax deduction is valid only for charitable donations. More specifically you cannot claim any amount paid in connection with influencing legislation as a business expense.

There is a list of tax-exempt organizations listed by the IRS if you are unsure whether the organization qualifies. In a nutshell the quick answer to the question Are political contributions deductible is no. The IRS guidelines also go beyond just direct political contributions.

Are Political Contributions Tax Deductible for Businesses. Contributions or expenditures made by a taxpayer engaged in a trade or business designed to encourage the public to register and vote in Federal state and local elections and to contribute to the campaign funds of the candidate or party of their choice are deductible by the taxpayer. Montana offers a tax deduction.

Businesses cannot deduct contributions they make to political candidates and parties or expenses related to political campaigns. Simply put political contributions are not tax-deductible.

Are Political Contributions Tax Deductible Anedot

Are Political Donations Tax Deductible Credit Karma

Are Political Contributions Tax Deductible

Reducing Tax Burden Different Sections Like 80c 80d Etc Detailed Infographic By Livemint Incometax Public Provident Fund Tuition Fees Tax Deductions

Are My Donations Tax Deductible Actblue Support

Sample Christmas Donation Postcards Examples Of Donation Cards Http Pfa Blog Com Home 3 Examples Of Card Template Card Templates Free Small Business Cards

Are My Donations Tax Deductible Actblue Support

Deductible Or Not A Tax Guide A 1040 Com A File Your Taxes Online Business Tax Tax Write Offs Business Bookeeping

Are Political Contributions Tax Deductible

Are Political Contributions Tax Deductible Anedot

Are Your Political Contributions Tax Deductible Taxact Blog

Are Political Contributions Tax Deductible H R Block

Are Political Contributions Tax Deductible H R Block

Why Political Contributions Are Not Tax Deductible

Why Political Contributions Are Not Tax Deductible

Are Political Contributions Tax Deductible